Navigating EU VAT with Skool: A Merchant of Record Guide

If you're looking to sell digital goods in Europe, the complexities of VAT compliance might overwhelm you. Let's explore how Skool acts as a Merchant of Record (MOR), simplifying the tax process and allowing you to focus on growing your community without the burden of managing taxes in multiple countries.

Table of Contents

- Understanding VAT Challenges in Europe

- The Role of a Merchant of Record

- How Skool Functions as an MOR

- Common Misconceptions About MORs

- Hybrid Models and Their Implications

- The Benefits of Using Skool for Tax Management

- Understanding the Reversed Invoice Process

- Navigating Skool's Help Documentation

- VAT Compliance Made Easy with Skool

- Setting Up Your Skool Account for Payouts

- The Importance of Having an EU VAT Number

- Finding Help and Support on Skool

- Addressing Common Confusions About MORs

- Conclusion: Simplifying Your Digital Business with Skool

- FAQ on Skool and EU VAT

Understanding VAT Challenges in Europe

Navigating VAT when selling digital goods in Europe is really tough. It's tricky for businesses to sell across the EU because each country has different tax rules. It's so complex that businesses sometimes pay more for accounting than they earn from sales.

The intricacies of VAT laws mean that businesses must stay updated on varying rates and regulations, which can change frequently. The process can be overwhelming, especially for those who may not have prior experience navigating these waters. It’s crucial to understand that without proper management, your business could face compliance issues that may lead to fines or penalties.

The Role of a Merchant of Record

A Merchant of Record (MOR) is essential in simplifying the sales process, particularly for businesses selling digital products. An MOR takes on the responsibility of processing payments and managing tax compliance, which eases the burden from the seller.

Essentially, when you work with an MOR, they become the official seller to your customers. This means that they handle all invoicing, payment processing, and tax remittance on your behalf. As a result, you can focus on creating and selling your products without worrying about the complexities of VAT or sales tax compliance.

How Skool Functions as an MOR

Skool operates as a Merchant of Record, meaning it handles all the tax compliance and payment processing for your digital products. When customers purchase access to your community, they are making a transaction with Skool, not directly with you.

As the seller, Skool takes on the responsibility of issuing invoices and collecting payments. This approach simplifies your accounting and guarantees fulfillment of all VAT obligations. Every time a member pays for access, Skool automatically handles the VAT, making the process seamless for you.

Common Misconceptions About MORs

One of the most prevalent misconceptions about a Merchanta Merchant of Records is that they are merely payment processors. In reality, an MOR offers a more comprehensive service that includes managing taxes and compliance.

- MOR vs. Payment Processors: While payment processors like Stripe facilitate transactions, they do not handle tax compliance (although they can help). An MOR, however, takes full responsibility for both payments and tax obligations.

- Understanding Hybrid Models: Some companies operate under a hybrid model, acting as both an MOR and a payment processor. This can create confusion, as businesses may not understand the scope of services offered.

- Client Relationships: When using an MOR, your direct clients become the MOR's clients. This shifts the responsibility of customer service regarding payments and compliance to the MOR. Although in most cases you, as the product or service creator, take responsibility for the customer service.

Hybrid Models and Their Implications

In hybrid model scenarios, a company may function both as a Merchant of Record (MOR) and a payment processor, which can lead to confusion regarding roles and responsibilities.

Ultimately, choosing the right model is crucial for ensuring smooth operations and compliance. Skool provides a straightforward solution by allowing you to focus solely on your community while they handle all financial and tax-related aspects.

⚠️ However, you also have the option to forgo Skool's payment processing services. In this scenario, you would assume full responsibility for issuing invoices, collecting payments, and managing all tax obligations associated with your sales.

The Benefits of Using Skool for Tax Management

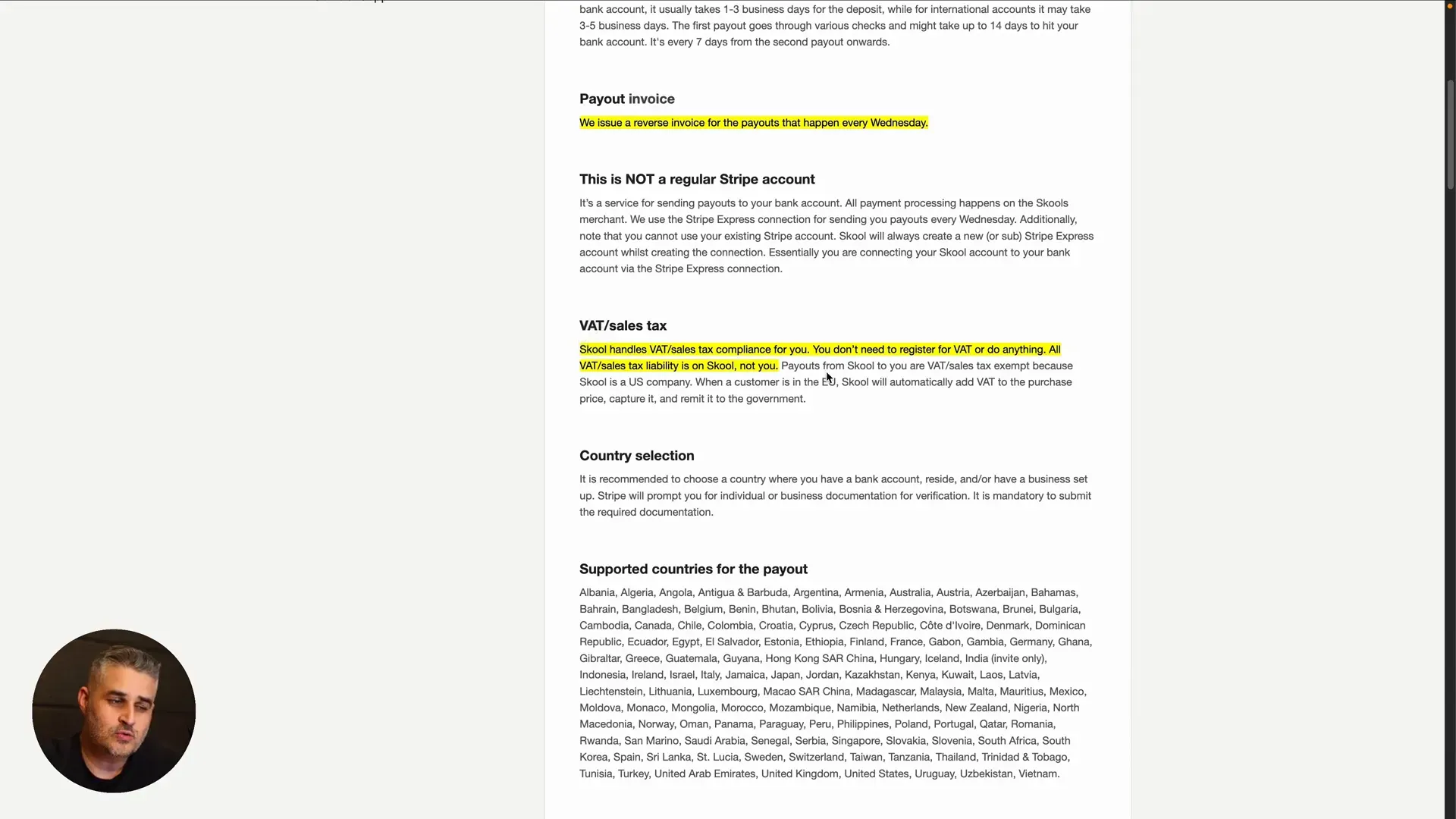

Skool simplifies tax management in several ways. First and foremost, it assumes full responsibility for VAT compliance. This means you don’t need to worry about registering for VAT or managing tax rates across multiple countries.

Furthermore, Skool's automated processes mean you receive payments promptly, typically on a weekly basis. This consistent cash flow allows you to plan and invest in your community without financial uncertainty.

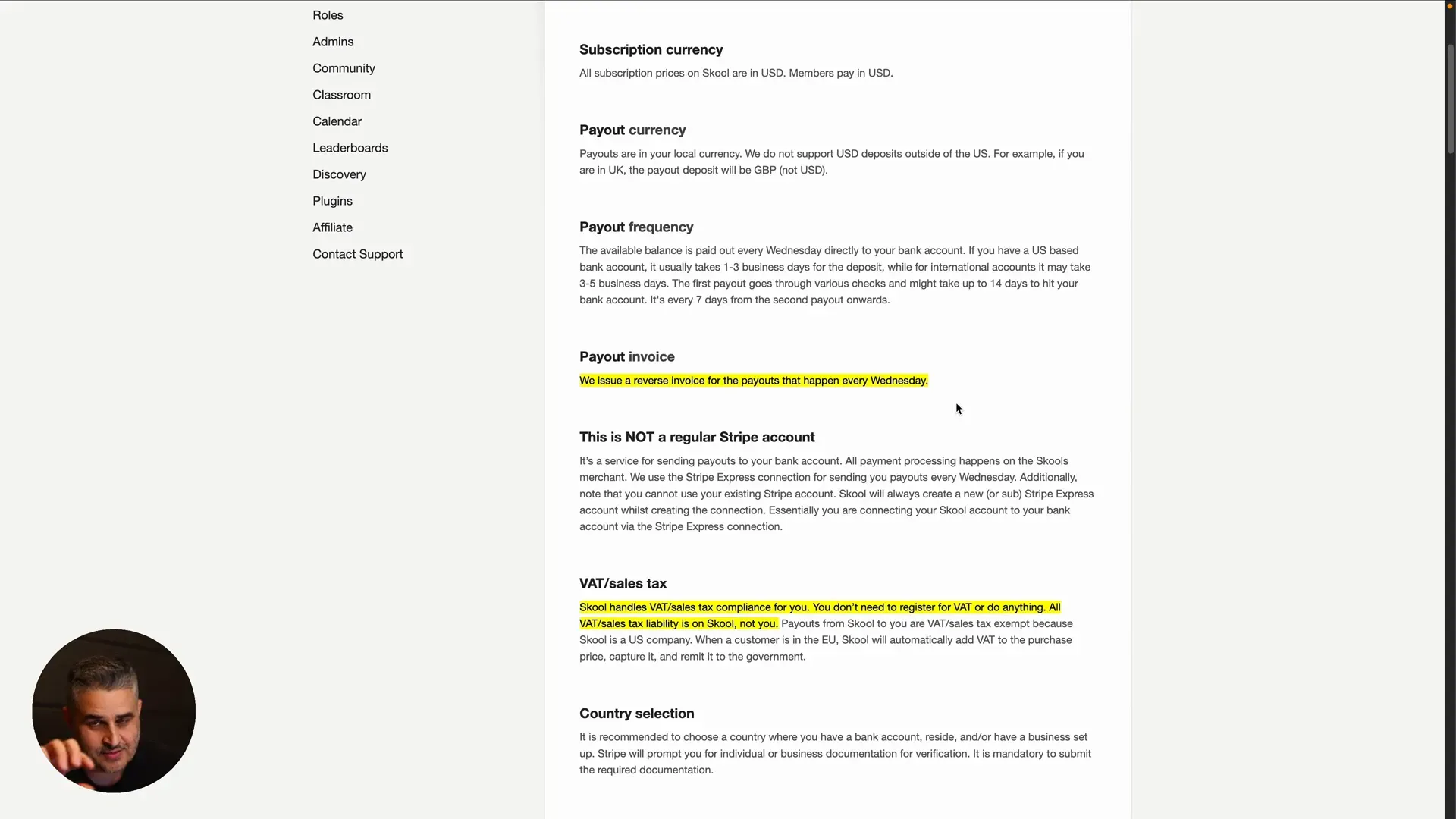

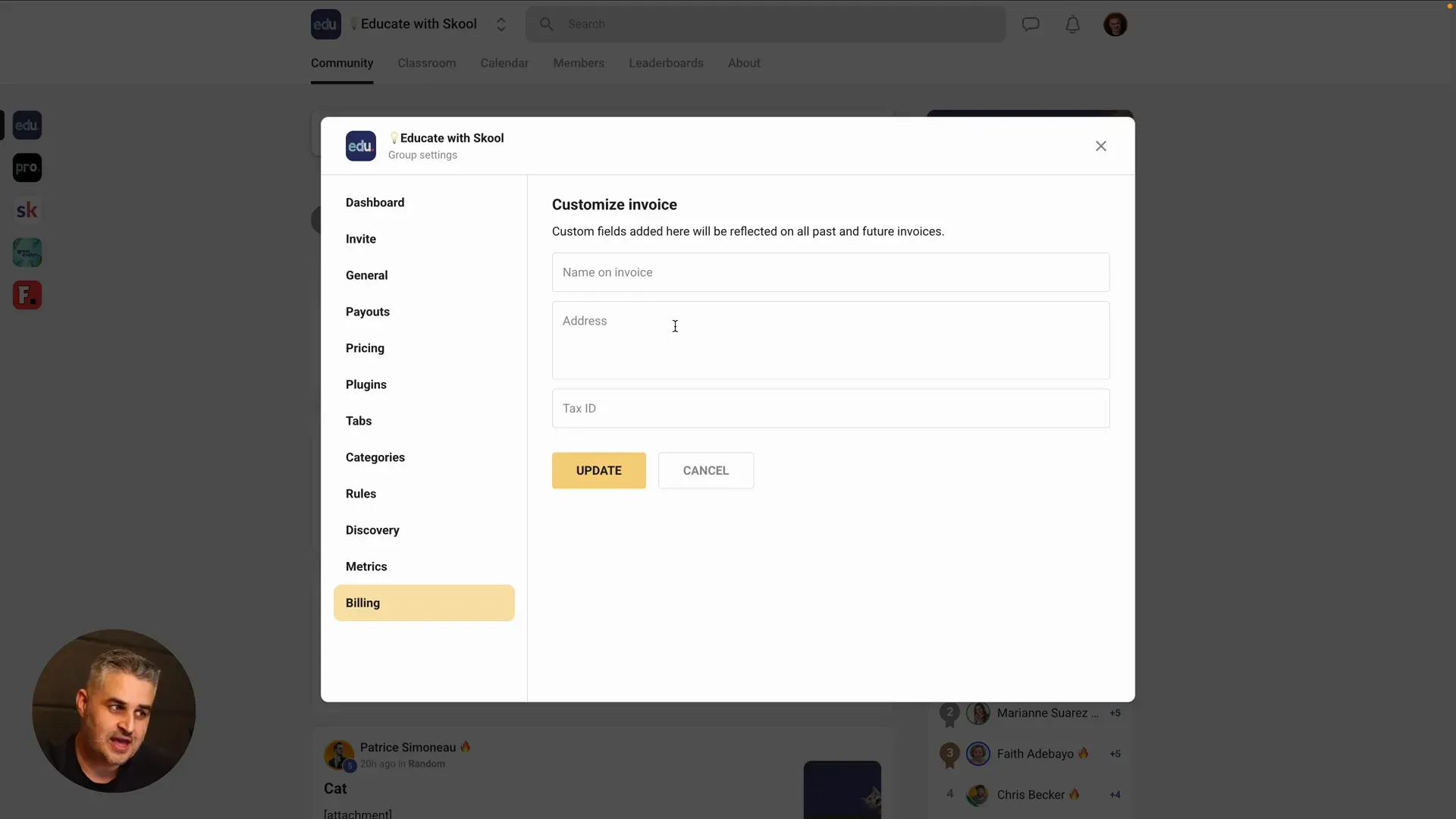

Another significant advantage is the issuance of reversed invoices. These invoices are generated by Skool, making it easier for your accountant to understand the transaction and ensuring compliance with tax regulations.

Understanding the Reversed Invoice Process

Reversed invoices are a unique feature of working with a Merchant of Record like Skool. Typically, in standard transactions, the seller issues an invoice to the buyer. However, with an MOR, the process is flipped.

When a payment is made, Skool collects the funds and then issues a reversed invoice to you. This invoice reflects the transaction as if you were the seller, allowing you to provide it to your accountant for tax reporting.

This system simplifies your accounting tasks and ensures that all transactions are properly documented. It’s a straightforward solution that helps you maintain compliance without added stress.

Navigating Skool's Help Documentation

Skool offers comprehensive help documentation to assist users in navigating their platform. This resource is invaluable for understanding how to manage your community, handle payouts, and maintain compliance with VAT regulations.

To access this documentation, simply visit the help center and search for specific topics such as VAT or payment processing. The well-organized structure makes it easy to find the information you need, ensuring that you can operate your community effectively.

Additionally, if you encounter any challenges, Skool's support team is readily available to assist you in resolving any issues you may face.

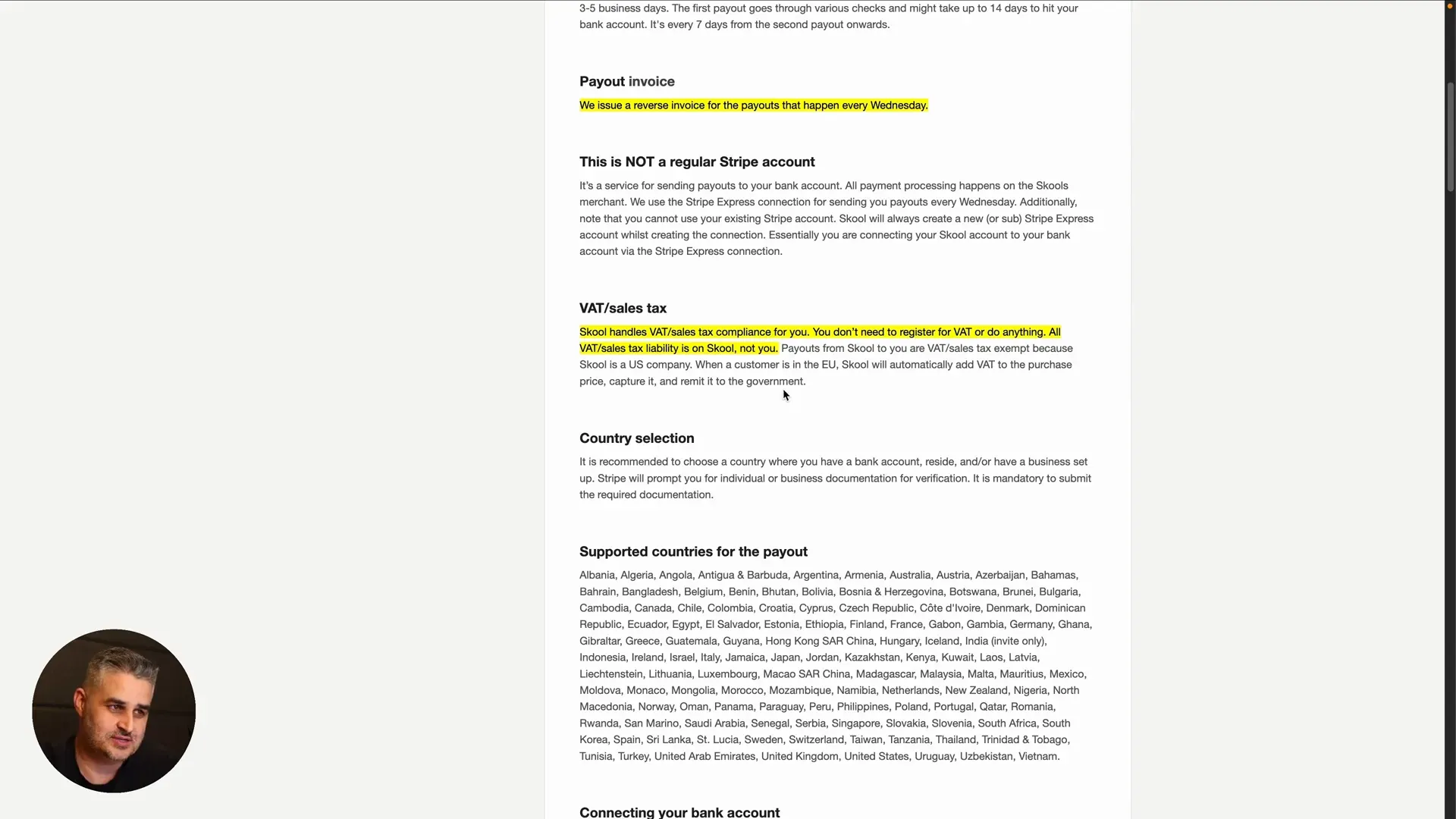

VAT Compliance Made Easy with Skool

VAT compliance can be a daunting task for many businesses, especially when selling digital goods across multiple EU countries. Skool simplifies this process by acting as your Merchant of Record. This means that all VAT obligations are handled by Skool, allowing you to focus on what truly matters: growing your community.

With Skool, you don’t have to navigate the complexities of VAT registration, varying tax rates, or filing requirements in each country. Skool automatically collects VAT, and remits it to the government on your behalf. This seamless process ensures that you remain compliant without the headache of managing taxes.

Setting Up Your Skool Account for Payouts

Once you decide to use Skool as your Merchant of Record, setting up your account for payouts is straightforward. First, navigate to your community settings and find the payouts section.

Here, you’ll see all the payments collected from your members. Ensure that your billing information is accurate; this includes your company name, address, and tax ID. It’s crucial to enter your EU VAT number correctly, as this will affect your compliance status.

The Importance of Having an EU VAT Number

If you're operating within the EU, having an EU VAT number is essential. This number is different from your usual VAT number and is necessary for businesses that engage in cross-border sales within the EU.

Registering for an EU VAT number ensures that your business is recognized in the European tax system. It allows you to operate legally and helps in avoiding potential penalties. Once registered, you’ll be able to provide this number in your Skool account settings, ensuring that all transactions are compliant.

Finding Help and Support on Skool

Skool provides extensive help documentation to assist users in navigating the platform. If you have questions about VAT compliance, payouts, or any other feature, the help center is your go-to resource.

Simply search for your topic of interest, such as "VAT" or "payouts," and you’ll find detailed guides and FAQs that can clarify your concerns. Additionally, Skool's support team is available to assist with any specific issues you encounter.

Addressing Common Confusions About MORs

Understanding the role of a Merchant of Record is crucial. Many people confuse MORs with payment processors, but they serve distinct functions. An MOR, like Skool, not only processes payments but also manages tax compliance on your behalf.

- Client Relationships: Your members are clients of Skool, not directly yours. This means all invoicing and payment issues are handled by Skool.

- Payment Processing: While payment processors handle transactions, they do not manage tax obligations. An MOR takes on this responsibility, providing a more comprehensive service.

- Hybrid Models: Some companies offer both MOR and payment processing services, which can cause confusion. Understanding the distinctions is key to making informed decisions.

Conclusion: Simplifying Your Digital Business with Skool

Using Skool as your Merchant of Record can significantly simplify your digital business operations. By handling VAT compliance and payment processing, Skool allows you to focus on building and nurturing your community. You no longer have to worry about the complexities of tax laws across different countries.

With automated payouts and reversed invoices, your accounting becomes less cumbersome, ensuring that you can maintain compliance without excessive effort. Skool is designed to make your life easier, making it the ideal partner for digital entrepreneurs.

FAQ on Skool and EU VAT

- Do I need to register for VAT if I'm using Skool? No, Skool handles all VAT compliance for you, so you don’t need to register separately (if you use their payments when billing members).

- How often will I receive payouts? Payouts are typically processed every Wednesday, allowing for consistent cash flow.

- What is a reversed invoice? A reversed invoice is issued by Skool to reflect the transaction, simplifying your accounting process.

- Can I sell digital goods outside the EU with Skool? Yes, Skool manages VAT compliance for sales made within the EU, allowing you to focus on your global customer base.